Waterproofing Contractor Insurance California – Seal the Risks Before They Leak

Waterproofing contractors play a vital role in protecting buildings against water intrusion, structural damage, and mold growth. But while you help clients avoid costly repairs, your own business faces daily risks on-site. One misstep could lead to injuries, lawsuits, or financial damage.

That’s where waterproofing contractor insurance steps in—to protect your operations, your equipment, and your future earnings across California and beyond.

You can begin coverage today right here

Why You Need Insurance as a Waterproofing Contractor

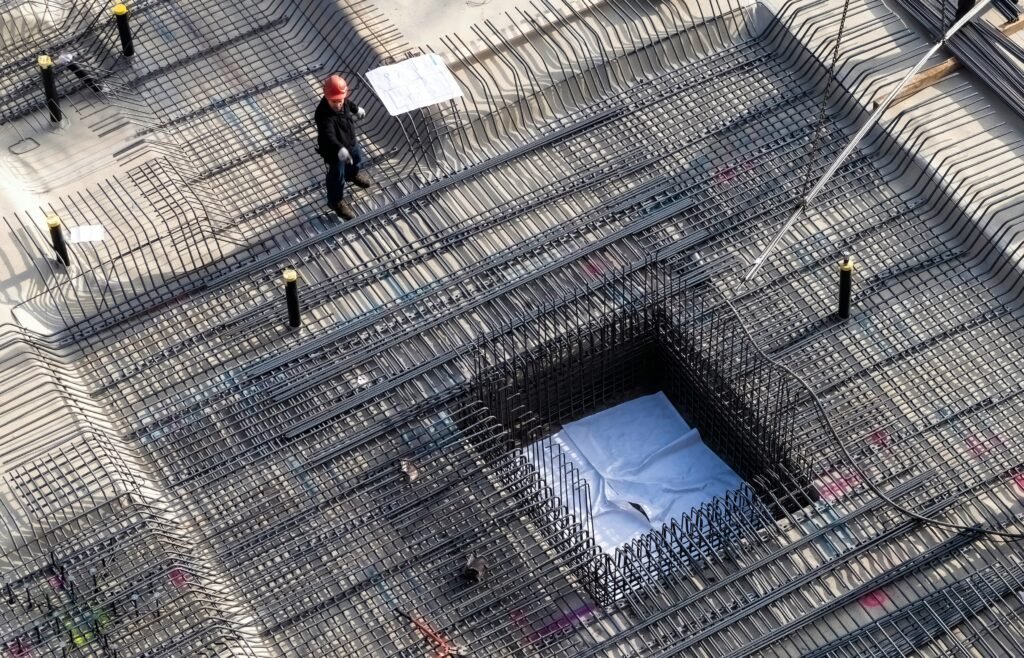

Working in basements, roofs, crawl spaces, and foundations exposes your team to high liability. Slippery surfaces, chemical sealants, and heavy equipment can lead to accidents or third-party claims.

A single mistake could damage a client’s property or injure an employee—and without insurance, the costs come out of your pocket.

Waterproofing contractor insurance provides a financial safety net for:

Property damage you may cause

Injuries to clients, visitors, or subcontractors

Employee injuries on the job

Equipment damage or theft

Legal fees and settlements

Who Needs Waterproofing Contractor Insurance?

If you perform any of the following services in California, you need specialized insurance to match your risk profile:

Below-grade waterproofing

Roofing sealant services

Foundation moisture barrier application

Deck and balcony waterproofing

Concrete coatings and membrane systems

Interior waterproofing (basements, crawl spaces)

Fast Easy Contractor Insurance in California

Wondering how we find the best contractors insurance in California? It’s simple. Just share a few details, and we’ll handle the rest—quick, hassle-free, and built around your trade.

Start Online

Enter some basic info on our website.

We Shop For You

We check with multiple insurance carriers.

Choose Your Plan

We present multiple options to pick from.

California Licensing & Insurance Requirements for Waterproofing

In California, waterproofing work typically falls under classifications like C-33 (Painting and Decorating) or C-39 (Roofing Contractor) depending on the scope of services. Regardless of license type, you’re often required to show proof of general liability and workers’ compensation.

Large commercial clients and general contractors often demand insurance certificates before letting you start work. Don’t risk losing bids—ensure you’re covered with a compliant and reliable policy here.

Why Contractors Across California Trust Our Insurance

We specialize in offering flexible, affordable insurance tailored to trade professionals like waterproofers. With deep knowledge of California’s contracting rules, we’ll help you avoid delays, fines, or coverage gaps.

Choose us for:

Same-day coverage and COIs

Monthly payment options

Flexible add-ons for specialty jobs

Expert support for insurance compliance

Fast online quotes and renewals

You can explore full contractor coverage offerings here or visit our home to navigate based on your trade.

Key Insurance Policies for Waterproofing Contractors in California

Every waterproofing business has different needs depending on the type of services, number of employees, and job site locations. However, most contractors benefit from the following core coverages:

General Liability Insurance

This covers third-party injuries or property damage. For example, if you accidentally crack a foundation or cause water damage during application, this policy helps with repair costs, medical bills, or lawsuits. Learn more about this policy here.

Business Owner’s Policy (BOP)

A BOP is an efficient way to bundle general liability with commercial property insurance. It covers your tools, gear, office space, and even business interruption costs. Details can be found here.

Workers’ Compensation Insurance

If you have employees in California, this coverage is mandatory. It pays for workplace injury-related expenses like medical treatment, lost wages, and rehabilitation.

Equipment and Tools Coverage

Waterproofing requires specialized gear—sprayers, airless applicators, sealant tanks, and more. This protects your tools from jobsite theft or damage.

We're here to help make sense of bonds and contractors insurance. Start a conversation with us today.

Our friendly team of agents will help save you time, aggravation, and money when it comes to your commercial insurance coverages.