Electrical Sign Contractor Insurance in California – Light Up Your Business, Not Your Liability

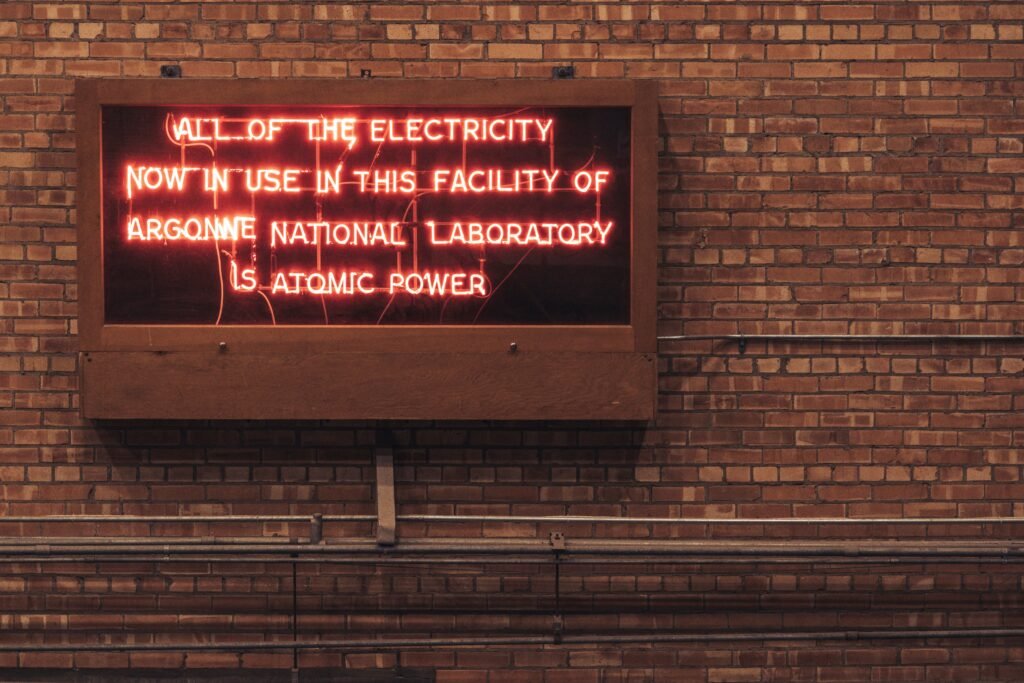

From neon storefront signs to high-rise LED displays, electrical sign contractors shape the visual identity of businesses across California. But behind the glowing lights and polished finishes are high-risk job sites, dangerous electrical systems, and elevated work areas. One error, accident, or equipment malfunction can lead to serious injury, property damage, or lawsuits.

That’s why every electrical sign installer and fabricator should carry Electrical Sign Contractor Insurance—specialized coverage that keeps your business secure, your employees protected, and your clients confident.

You can get coverage today through our fast, expert contractor insurance quotes here.

Why Electrical Sign Contractors Need Insurance

Working at heights, handling electrical connections, and operating lifts or cranes aren’t just physically demanding—they come with liability. A dropped fixture, miswired sign, or scaffold mishap could trigger thousands in damages or injuries.

Electrical Sign Contractor Insurance in California is your shield against:

Client property damage caused by installation or removal

Third-party injury from falling tools or signage

Jobsite electrical fires

Worker injuries from electrocution or falls

Lawsuits, legal costs, and equipment replacement

Who Should Carry Electrical Sign Contractor Insurance?

Whether you fabricate, install, repair, or service signs, if your work involves electricity or structural support, you need this coverage. Common trades covered include:

LED and neon sign installers

Channel letter fabricators

Pylon and monument sign contractors

Digital signage installers

Crane or boom truck operators in signage

Sign maintenance and electrical retrofitting services

Fast Easy Contractor Insurance in California

Wondering how we find the best contractors insurance in California? It’s simple. Just share a few details, and we’ll handle the rest—quick, hassle-free, and built around your trade.

Start Online

Enter some basic info on our website.

We Shop For You

We check with multiple insurance carriers.

Choose Your Plan

We present multiple options to pick from.

California Legal Requirements and Insurance for Sign Contractors

In California, the C-45 license permits sign construction, installation, and repair. To stay compliant:

You must carry workers’ compensation insurance if you have employees.

Many commercial clients require $1M+ general liability coverage.

Larger jobs may demand additional insured endorsements.

Need help meeting state licensing rules and contract terms? Our contractor advisors can tailor your plan here.

Benefits of Choosing Us for Sign Contractor Insurance in California

We specialize in insurance solutions tailored for trades and contractors, including high-risk professions like electrical signage. With us, you’ll get:

Custom plans that meet local code and licensing needs

Affordable monthly payment options

COIs (Certificates of Insurance) issued fast

Advisors who understand contractor risks

Easy renewals and adjustments as your business grows

Get started with an instant quote or compare full contractor options here.

Key Insurance Coverages for Electrical Sign Contractors

General Liability Insurance

This foundational policy protects you if your sign installation or service causes damage or injury to a third party. It’s crucial for accidents like dropped signage or client slip-and-fall incidents. Learn more about this policy here.

Business Owner’s Policy (BOP)

Bundle your general liability with property insurance to cover your office, workshop, design equipment, and even stolen tools. It’s the most cost-effective package for small to medium contractors. Full BOP details are available here.

Workers’ Compensation Insurance

Required in California if you have employees. It covers medical costs and lost wages after on-the-job injuries like electrical shock, back strain, or ladder falls.

We're here to help make sense of bonds and contractors insurance. Start a conversation with us today.

Our friendly team of agents will help save you time, aggravation, and money when it comes to your commercial insurance coverages.