Choose from the nation's best insurance providers

Business Owner’s Policy (BOP) Cost for Contractors in California and the USA

If you’re a contractor in California or anywhere in the U.S., protecting your business doesn’t have to break the bank. A Business Owner’s Policy (BOP) offers a smart, cost-effective way to combine essential coverage—general liability insurance and commercial property insurance—into one convenient package.

What Is the Average Cost of a Business Owner’s Policy?

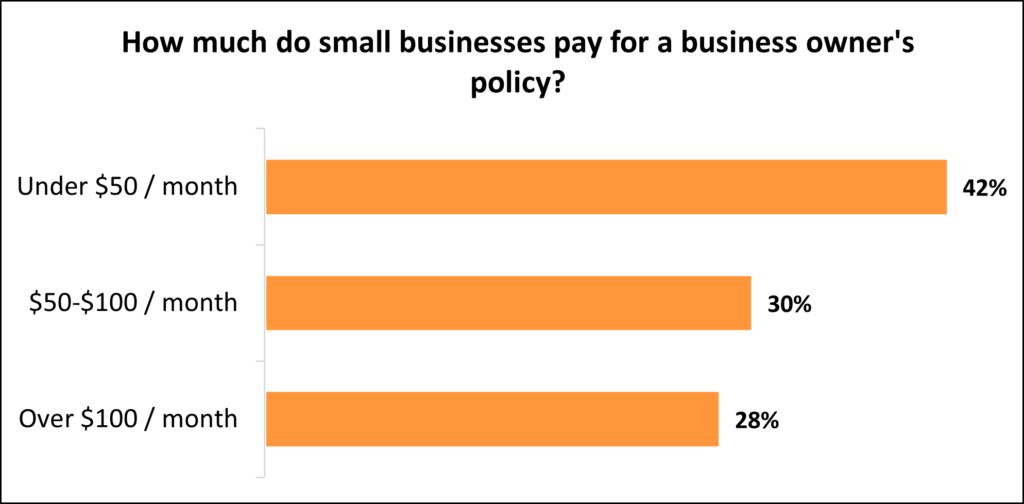

On average, small businesses pay around $57 per month for a BOP, which totals approximately $684 per year. This bundled approach often costs less than purchasing each policy separately, making it a popular choice among contractors, remodelers, and tradespeople.

How Much Do Contractors Typically Pay?

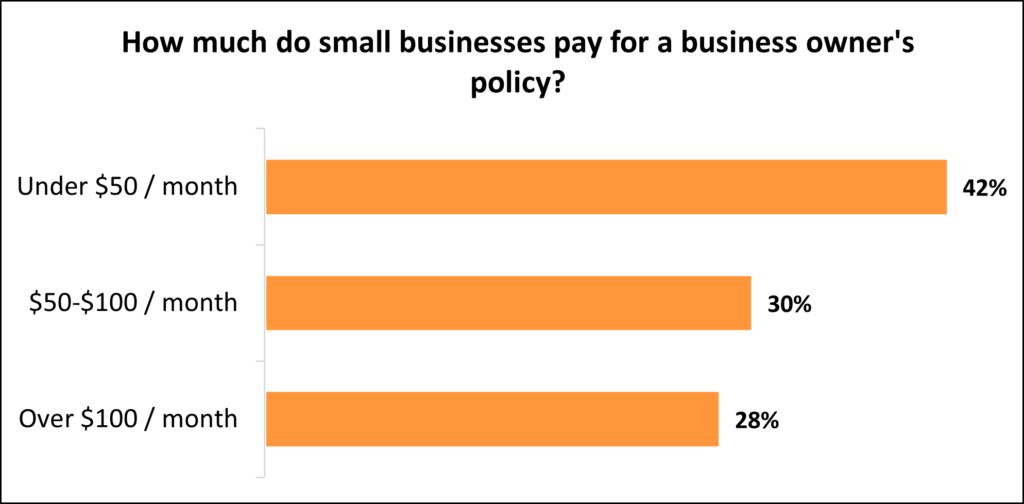

According to recent data from Insureon:

42% of small business owners pay less than $50/month for their BOP

30% pay between $50 and $100/month

That means nearly three-quarters of small business owners are securing solid protection for under $100 monthly—making BOP coverage both affordable and accessible for independent contractors and small construction businesses.

Why Contractors Should Consider a BOP

A Business Owner’s Policy for contractors offers critical protection from lawsuits, theft, fire, vandalism, and property damage—all in one policy. It’s ideal for:

General contractors

Remodeling and renovation professionals

Electricians, plumbers, HVAC techs

Handymen and specialty contractors

What Factors Affect Your BOP Cost?

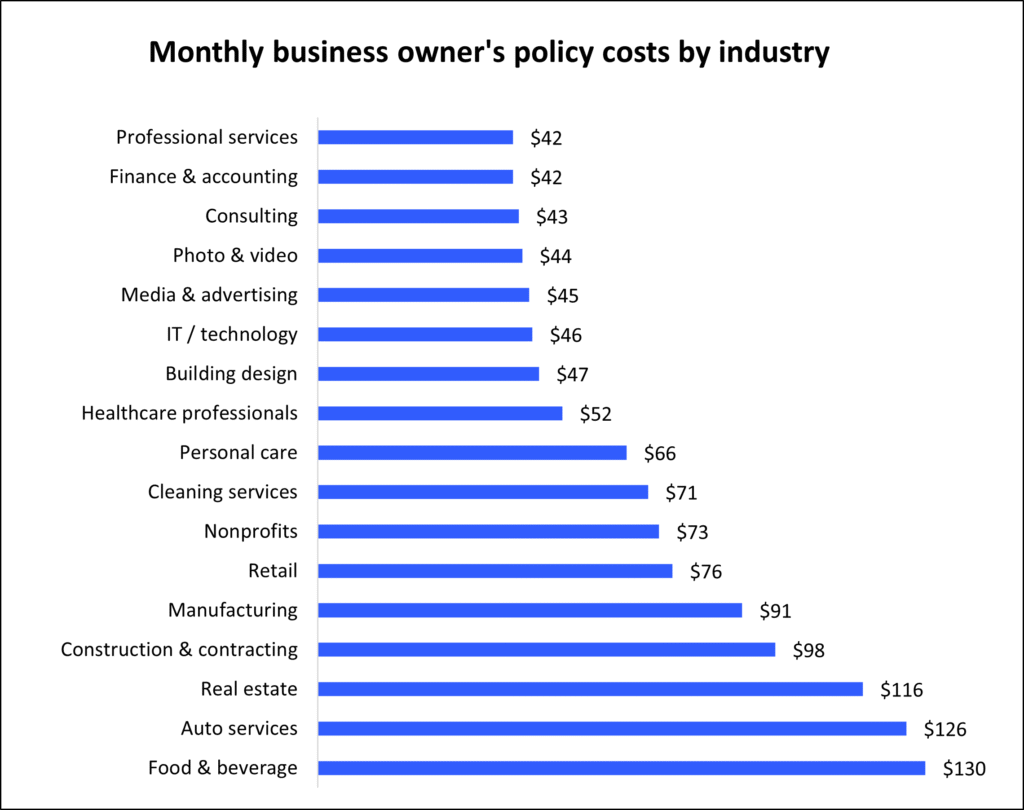

The price of your Contractor Business Owner’s Policy depends on several key factors:

The policy limits you choose

The value of your tools, equipment, and business property

Your industry-specific risk level

Your location (contractors in high-risk areas or urban centers may pay more)

Claims history and business size

A roofing contractor in California, for example, might pay more than a handyman in a low-risk rural town due to increased liability and property risks.

5 Reasons Your Business Needs a BOP

Looking for a Business Owner’s Policy for Contractors?

Get the protection your business deserves—start your free BOP insurance quote today. At [Your Business Name], we specialize in Business Owner’s Policies for contractors across California and the USA, including construction, remodeling, HVAC, and more. With decades of experience, we make it simple to get reliable, affordable coverage online. No hassle. No pressure. Just the right insurance—fast.

1. Employees:

Workers can accidentally injure customers or cause property damage. With this policy, you'll have protection for them and your business.

2. Any chance of a lawsuit:

If a customer slips and falls at your store, this can help pay their medical expenses and your legal costs.

3. A physical location:

Your BOP policy can help cover businesses run out of your home, a rented or owned office, store or garage.

4. Assets that could get stolen or damaged:

Digital property, equipment, furniture, cash and inventory are all difficult to repair or replace without the right insurance.

5. Private customer data:

If someone steals or loses personally identifiable information, this can help pay expenses like notifying impacted clients and public relations.

Business Owner’s Policy FAQs

A Business Owner’s Policy (BOP) is a smart, affordable solution for contractors in California looking to simplify and strengthen their insurance coverage. Instead of buying separate policies, a BOP combines commercial property insurance and general liability insurance into one convenient package.

This bundled coverage helps protect your business from:

Fire and theft

Third-party lawsuits

Loss of business income

Our customized BOP insurance for contractors can also be enhanced with additional protections tailored to your needs, including:

Business income loss from utility outages

Data breach coverage

Professional liability insurance

By choosing a contractor BOP policy, you not only streamline your insurance but often save money over purchasing individual policies. It’s an ideal option for general contractors, remodelers, HVAC specialists, and other licensed professionals in California and across the USA.

Business income insurance is included in our Business Owner’s Policy (BOP) for California contractors. If your job site or office is forced to close due to a covered event—like fire damage—this coverage helps replace your lost income while repairs are made.

Your contractor business insurance with business income coverage ensures you can:

Keep paying operating expenses such as payroll, utilities, and rent

Recover lost income during downtime caused by property damage

Reopen your business faster with financial stability

This is a must-have for construction contractors, remodelers, electricians, and other licensed trades. When downtime strikes, your contractor BOP policy helps you stay protected and ready to rebuild.

General Liability Insurance covers your business if someone claims bodily injury, property damage, or advertising injury caused by your work. It’s essential coverage—but it’s just the beginning.

A Business Owner’s Policy (BOP) takes it further by combining:

General Liability Insurance

Commercial Property Insurance

Business Income Protection

With a contractor BOP policy, you’re not only covered for lawsuits and injuries, but also for property damage from events like fire, theft, or windstorms, and lost income while you recover.

If you’re a California contractor—whether you’re in construction, remodeling, HVAC, or electrical work—a BOP provides the broad protection your growing business needs.